Cost of Living in Vancouver 2025: (Data-Driven Guide)

Cost of Living in Vancouver 2025: (Data-Driven Guide)

Vancouver consistently ranks as one of Canada’s most expensive cities to live in, and 2025 continues this trend with rising housing costs and everyday expenses that can shock newcomers. If you’re considering moving to this beautiful West Coast city, understanding the true cost of living becomes essential for making informed decisions about your future.

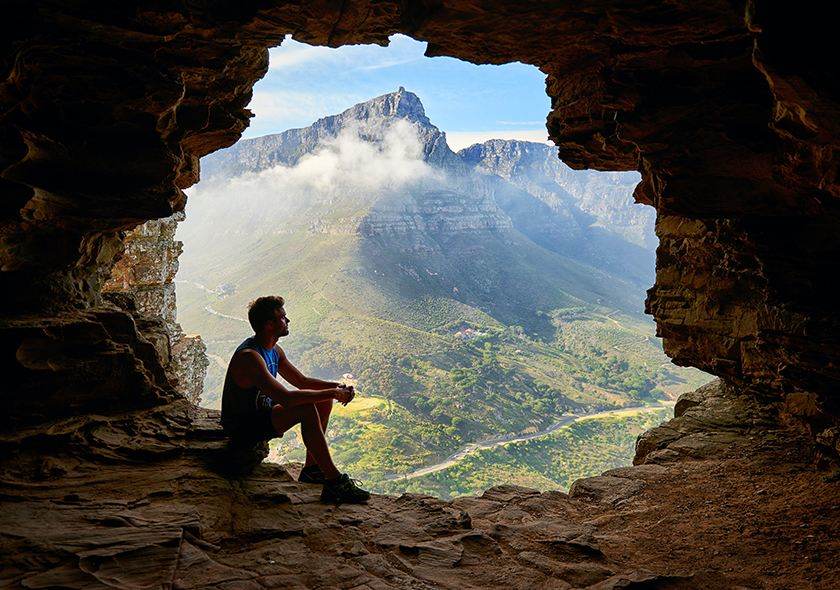

The city’s stunning natural beauty, mild climate, and thriving job market attract people from around the world, but these same factors drive up demand and prices across all sectors. Vancouver is one of Canada’s most desirable places to live, which comes with a premium price tag that affects everything from housing to groceries.

Whether you’re relocating for work, family, or lifestyle reasons, knowing what to expect financially helps you plan properly. Many newcomers find that temporary housing through Vancouver short term rentals provides flexibility while they explore neighborhoods and understand the local market before committing to long-term arrangements.

Vancouver Cost of Living Overview 2025

Cost of Living Index and National Comparison

Vancouver’s cost of living index sits significantly higher than the national average, making it the second most expensive city in Canada after Toronto. According to current data, Vancouver’s overall cost of living runs approximately 25-30% above the Canadian average, with housing being the primary driver of these elevated costs.

The city’s expense level reflects its status as a major international destination and economic hub. While salaries in many sectors tend to be higher than in other Canadian cities, they don’t always keep pace with the rapid increase in living costs, particularly housing. This creates a challenging environment for both newcomers and long-term residents trying to maintain their standard of living.

According to Statistics Canada’s Consumer Price Index data, Vancouver experienced a 4.2% increase in overall living costs in 2024, with housing leading the charge at 6.8% growth, significantly outpacing wage increases across most sectors.

How Vancouver Compares to Other Canadian Cities

When comparing Vancouver to other major Canadian cities, the differences become stark. Vancouver consistently outranks Toronto, Montreal, and Calgary in terms of overall expense, though the gap with Toronto has narrowed in recent years.

The city’s housing market drives much of this disparity, with average home prices and rental costs exceeding most other Canadian urban centers.

Housing Costs in Vancouver

Housing represents the largest expense for most Vancouver residents, typically consuming 40-50% of household income. The rental market has seen significant increases throughout 2024, with average one-bedroom apartments in desirable neighborhoods ranging from £2,200 to £3,500 monthly. Two-bedroom units command between £3,200 and £5,000, depending on location and amenities.

The rental market remains extremely competitive, with vacancy rates below 2% in many areas. This low availability gives landlords considerable leverage in setting prices and selecting tenants, often requiring employment verification, references, and first and last month’s rent upfront. Many newcomers find success working with premium services like Corporate Stays to secure furnished accommodations while navigating and enjoying the city.

Downtown Vancouver commands premium prices, but neighborhoods like Kitsilano, Commercial Drive, and Mount Pleasant offer slightly more affordable options while maintaining good transit connections. Newer developments typically cost more than older buildings, though they often include modern amenities and energy-efficient features that can offset utility costs.

Renting vs Short Term Rentals

Vancouver’s competitive rental market has led many residents and newcomers to explore alternative housing arrangements, with short term rentals emerging as an increasingly popular solution.

Traditional long-term rentals require lengthy lease commitments, substantial deposits, and often involve bidding wars among prospective tenants in the city’s tight housing market.

Short-term rentals offer significant advantages for Vancouver’s dynamic population. These furnished accommodations provide immediate availability without the stress of furniture shopping, utility setup, or long-term commitments that can lock residents into unsuitable situations.

For professionals on temporary assignments, students, or newcomers still exploring neighborhoods, short-term rentals eliminate the pressure of making permanent housing decisions quickly.

Transportation and Getting Around Vancouver

Public Transportation Costs (TransLink, SkyTrain, Bus)

Vancouver’s public transportation system, operated by TransLink, offers comprehensive coverage throughout Metro Vancouver, including buses, SkyTrain rapid transit, and SeaBus connections.

Monthly transit passes cost £181 for three zones, covering most areas where residents live and work. Single-zone passes at £136 monthly work for those staying within Vancouver proper.

The SkyTrain system connects downtown Vancouver to Richmond, Burnaby, Surrey, and other municipalities, making car-free living viable for many residents. The regional transportation network continues expanding, with new lines and stations improving connectivity between previously underserved areas.

Daily Living Expenses

Food costs in Vancouver run approximately 15-20% higher than the Canadian average, with fresh produce, dairy, and meat showing the most significant price premiums.

A typical grocery budget for a single person ranges from £350-£500 monthly, while families of four often spend £800-£1,200, depending on dietary preferences and shopping habits.

The city’s diverse population supports an excellent restaurant scene, though dining out costs reflect Vancouver’s high commercial rents and labor costs. Casual restaurant meals typically cost £15-£25 per person, while mid-range dining runs £30-£50 per person before drinks and tips.

- Utilities and Household Bills

Utility costs in Vancouver remain relatively moderate compared to other major expenses. BC Hydro electricity bills average £80-£120 monthly for typical apartments, though this varies significantly based on heating systems, building efficiency, and personal usage patterns. Natural gas bills for heating and hot water add another £30-£80 monthly, with higher costs during winter months.

Internet and cable services from major providers like Telus and Shaw typically cost £60-£120 monthly for basic packages, while cell phone plans range from £50-£90 monthly for adequate data allowances. These telecommunications costs align closely with those of other major Canadian cities.

Average Annual Income for Comfortable Living in Vancouver

| Household Type | Annual Income Range (CAD) | Comfort Level |

| Single Person | £70,000–£85,000 | Modest but comfortable |

| Couple | £90,000–£120,000 | Moderate comfort with flexibility |

| Family of Four | £120,000–£150,000 | Comfortable with family support |

Healthcare and Insurance Costs

Medical Services Plan (MSP) and Healthcare Coverage

British Columbia’s Medical Services Plan provides basic healthcare coverage for residents, though MSP premiums were eliminated in 2020, reducing monthly expenses for most households.

The healthcare system covers essential medical services, hospital care, and emergency treatment, providing significant value compared to private healthcare systems in other countries.

MSP covers routine medical appointments, specialist referrals, and hospital stays, but excludes dental care, vision care, prescription medications, and many therapeutic services. Most employers offer extended health benefits that cover these gaps, though self-employed individuals and those without employer coverage may need private insurance.

Salary and Budget Planning for Vancouver

| Expense Category | Single Person Monthly | Family of Four Monthly | Percentage of Budget |

| Housing (Rent) | £2,500 | £4,200 | 35-45% |

| Transportation | £180 | £360 | 8-12% |

| Food/Groceries | £450 | £1,000 | 12-18% |

| Utilities | £120 | £200 | 3-5% |

| Healthcare/Insurance | £150 | £300 | 3-6% |

| Other Expenses | £600 | £1,200 | 15-25% |

| Total Monthly | £4,000 | £7,260 | 100% |

Cost of Living Calculator and Budgeting Tips

Effective budgeting in Vancouver requires careful tracking of all expenses and realistic expectations about lifestyle adjustments. Many newcomers underestimate the cumulative impact of higher costs across all categories, not just housing.

Successful Vancouver residents often employ strategies like meal planning to control food costs, using transit instead of car ownership, finding free or low-cost entertainment options, and taking advantage of the city’s extensive outdoor recreation opportunities. The city’s natural beauty provides countless free activities year-round, from beach visits to mountain hiking.

Building an emergency fund becomes particularly important given Vancouver’s high costs and competitive job market. Most financial advisors recommend 3-6 months of expenses in emergency savings, though Vancouver’s elevated costs make this challenging for many residents to achieve quickly.

Frequently Asked Questions

- Is £100,000 a good salary in Vancouver? A £100,000 salary provides a comfortable lifestyle for a single person in Vancouver, though housing costs will still consume a significant portion.

- Why is Vancouver so expensive compared to other Canadian cities? Vancouver’s high costs result from limited land availability due to geography, strong international investment, desirable climate, and robust immigration.

- What’s a realistic monthly budget for a single person in Vancouver? A realistic monthly budget for a single person ranges from £3,500-£4,500, including modest housing, transportation, food, and basic entertainment.

- How much do you need to buy a house in Vancouver? Home purchases typically require £150,000-£300,000 down payments plus additional closing costs.

Is it cheaper to live in Vancouver or Toronto? Vancouver and Toronto show similar overall costs, though Vancouver’s housing costs slightly exceed Toronto’s while other expenses like food and transportation are comparable.