Complete Superyacht Investment Guide | Pommie Travels

Complete Superyacht Investment Guide | Pommie Travels

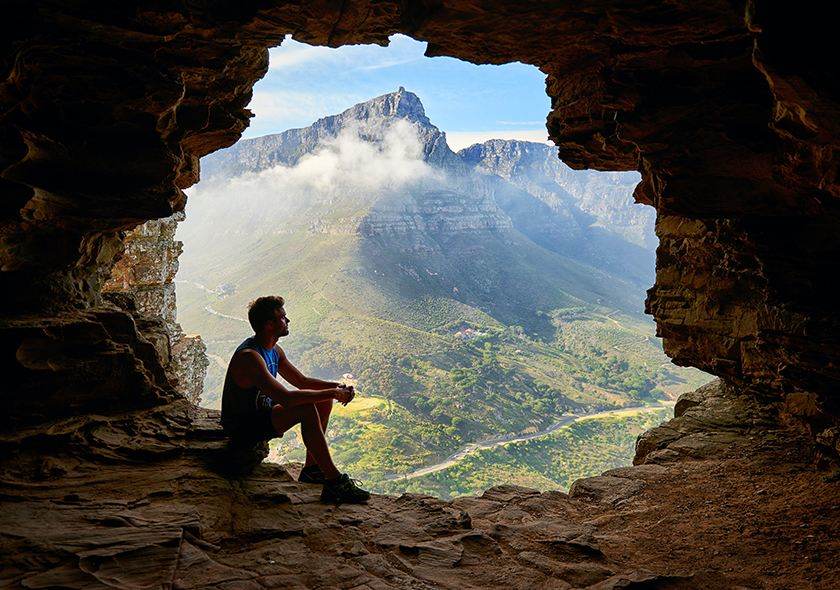

Owning a superyacht is not just about wealth—it’s about the ultimate form of freedom and adventure. The glimmering sea, five-star comfort, and the thrill of exploring hidden spots make superyacht ownership a dream for many. But turning that dream into a wise investment takes more than just picking out a beautiful boat. This guide breaks down every step, showing you how to approach superyacht investment with confidence and smarts—so you can enjoy the benefits while avoiding the common traps.

What Is a Superyacht Investment?

Superyachts are vessels over 24 meters (about 80 feet) long, floating mansions packed with luxury details. For some owners, a superyacht is a reward for hard work. For others, it’s a new business move.

But let’s be honest: a superyacht isn’t a typical investment like real estate or stocks. Many people think they will make a fortune, but yachts generally lose value over time. So, is “superyacht investment” a myth? Not exactly.

You can see a superyacht as:

- An asset you can charter out, sometimes recovering part of your costs.

- A lifestyle investment: access to amazing cruising grounds like the Greek islands, perfect for family and friends.

- A source of prestige and enjoyment, with the potential for some savvy owners to leverage tax benefits or create business opportunities around their yacht.

Here’s a simple analogy: buying a superyacht is like owning a country home. You may let friends visit for a fee, but at its heart, it’s about your enjoyment.

The Initial Purchase: What to Consider

The purchase stage sets the tone for your whole superyacht journey. Here, expert guidance is invaluable—this is where Roccabella brokerage shines, connecting you to global markets, legal resources, and trustworthy surveyors.

New vs. Pre-Owned

New Build: Offers total customization. Want a helipad? An eco-friendly hybrid engine? It’s all possible—but expect a longer waiting period and a higher price.

Pre-Owned: Faster to take possession, sometimes less expensive, but may require upgrades or repairs.

Key Choices Before Purchase

- Brand and Builder Reputation: The best names (like Feadship or Lürssen) hold value and appeal more to charter guests.

- Size and Features: Make sure your yacht is big enough for your plans (hosting guests, watersports, long trips).

- Due Diligence: Always commission a professional survey and sea trial to spot hidden issues.

- Paperwork: Legal checks on registration and title stop future headaches.

A skilled broker from Roccabella brokerage can help you weigh these details, keeping deals smooth and clear.

Ownership Structures and Tax Considerations

The way you own your yacht can save—or cost—you millions.

Private vs. Corporate Ownership

- Private: Simple, perfect if you use your yacht mainly for personal travel.

- Corporate: Sometimes delivers tax advantages, more privacy, and easier commercial operation, but adds paperwork and complexity.

Flags and Registration

Where your yacht “lives” on paper makes a difference. Common flags:

- Cayman Islands

- Marshall Islands

- Malta

These registries can lower fees, offer better privacy, or make it easier to charter in the Med and Greece.

Tax and Compliance

- VAT and Import Duties: These taxes can add 10–25% to your purchase price if mishandled. Every country is different—Greece, Italy, France, and Spain all have unique rules.

- Insurance: Premiums reflect usage, region, value, and crewing standards.

- International Safety Compliance (MCA, SOLAS): Every superyacht must meet strict standards for passenger safety and operations.

Hiring a maritime lawyer or advisor is non-negotiable for these complex waters.

Operating Costs: What You Should Know

If you’re prepared for operating costs, you’ll enjoy yacht ownership much more—no scary surprises.

Common Annual Expenses

- Crew Salaries: A top captain alone might earn £120,000/year, then add deckhands, chefs, and stewards.

- Maintenance & Repairs: Expect to replace parts, refit the decor, and service engines regularly.

- Fuel & Dockage: Big yachts burn through fuel—crossing the Med? That can mean £10,000+ in fuel each journey.

- Insurance: Rates vary, but plan on a significant premium.

- Admin/Legal Fees: Registration, compliance, and agents add up.

A good rule: annual costs run about 10–20% of the purchase price.

Cost-Saving Tips

- Off-season Storage: Winter your yacht in less expensive ports.

- Smart Technology: Modern monitoring systems can limit wear or predict repairs before they become costly.

- Professional Management: An experienced team can negotiate better contracts, avoid fines, and keep costs under control.

Chartering as a Revenue Stream

Luxury yachts can earn revenue by chartering, offsetting some (but rarely all) ownership costs. The superyacht investment angle often depends on Greece’s and the Mediterranean’s bustling summer seasons.

How Chartering Works

- Commercial License: Needed to accept paying guests.

- Legal Standards: Guests, safety, and service are all strictly regulated.

- Management: Most owners use a charter management company, which markets the yacht, books charters, manages contracts, and ensures all parties are happy.

Real-World Example

Maria’s 40-meter yacht charters in Greece for 10 weeks each summer, grossing €300,000, but with broker fees, maintenance, and extra crew, the profit is lower. Still, her operating costs drop by nearly half, and she gets to use her yacht in spring and fall.

Pros & Cons

Pros: Cash flow, crew stays busy, tax benefits in some regions.

Cons: Extra wear and tear, demands on scheduling, and less personal flexibility.

Managing and Maintaining Your Asset

Keeping your yacht in top shape isn’t just about pride—it protects resale value and guest safety.

Role of Yacht Managers

A professional manager acts as your eyes and ears:

- Coordinates crew, schedules, and repairs

- Tracks regulatory deadlines

- Arranges for upgrades and safety checks

- Handles charter logistics if you choose

Maintenance

- Routine Upkeep: Cleaning, minor fixes, monthly checks.

- Major Refits: New interiors, engine overhauls, technology upgrades.

- Emerging Trends: Green tech, better satellite internet, smart sensors, and even AI-driven preventive repairs.

Resale Value and Depreciation

Yachts lose value fastest in their first years, then level off. Top brands, modern tech, and perfect maintenance help keep your yacht attractive if you decide to sell.

Boosting Value

- Update Soft Goods: Fresh interiors boost the wow factor for buyers and charter clients.

- Eco Upgrades: Owners love solar panels or hybrid tech, and demand and value rise for these features.

- Detailed Records: For every repair, inspection, and charter, keep all paperwork.

Real-Life Market

During economic dips (like post-pandemic), buyers for large yachts may shrink, so flexibility in price and marketing is key. But the best-kept yachts—especially in the 30–50m range—still find buyers thanks to family-friendly layouts and range.

Risks and Challenges of Superyacht Investment

Superyacht investment comes with key risks:

- Market Swings: Financial crises shrink buyer pools and lower resale values.

- Long Listing Times: Sales often take 6–24 months.

- Hidden Costs: Surprise repairs, new regulations (like emission rules), or crew turnover.

- Changing Laws: Tax structure, charter rights, and cruising restrictions are always evolving, especially in the Med.

Always keep reserve funds for surprises, and revisit your ownership strategy annually.

Superyacht Investment Trends in 2025 and Beyond

A few standout trends for investors:

Eco & Explorer Yachts

- Green Tech: Hybrid engines, solar panels, and water treatment systems are in high demand.

- Explorer Models: Owners want to cruise remote areas, from Alaska to Antarctica.

Emerging Regions

- Asia & Middle East: More owners and charter guests come from these regions each year.

- Digital Syndicates: Groups of friends or investors now buy shares in a yacht, splitting time and running costs.

Greece Takes Center Stage

With stunning scenery and improved infrastructure, Greece is a top spot for charter income and superyacht enjoyment. The country’s popularity isn’t fading anytime soon.

Is Superyacht Investment Right for You?

Ask yourself:

- Do you seek profit, luxury, or prestige?

- Will your family or friends use the yacht enough to make it worthwhile?

- Are you comfortable with yearly costs and the time required—even with a manager?

- Would you use chartering for income, or only for personal travel?

- Are lifestyle benefits more important than financial returns?

Sometimes it’s smarter to enjoy a superyacht charter for a few years—sampling styles and regions—before taking the leap into ownership.

Mini Case Study: From Dream to Deck

Raj, a tech founder, wanted adventure but worried about time. With help from Roccabella brokerage, he purchased a 28-meter yacht built for efficiency and low crew costs. He bought a charter license for Greece, joined a digital syndicate for fractional ownership, and now spends every August cruising the Aegean, knowing his investment is well-managed the rest of the year.

Final Thoughts

Owning a superyacht is a bold move—a mix of smart planning, expert help, and enjoying one-of-a-kind experiences. Approach the process with eyes wide open and lean on professionals like Roccabella brokerage for honest advice and trusted guidance. Remember, the true value of a superyacht is often in the memories, the freedom of the sea, and the pride of unmatched adventure—not just numbers on a spreadsheet.

Study your options. Match your superyacht investment to both your dreams and your budget. And whether you’re drawn by the waves of Greece or the thrill of ownership worldwide, let your voyage be as rewarding as the destination itself.