The Platinum Card® from American Express Guide: 2025 Changes

The Platinum Card® from American Express Guide: 2025 Changes

What Changed in 2025

Annual Fee

The annual fee increased from £695 to £895 per year. With the increased annual fee comes a slew of new benefits.

Adding an additional card to your account now costs £195 per year (previously this was £175).

Companion cards are still free, but have limited benefits.

New and Increased Benefits

The refresh comes with several brand new benefits (more on this below).

Some of the previous benefits have been enhanced or increased to offer even more value.

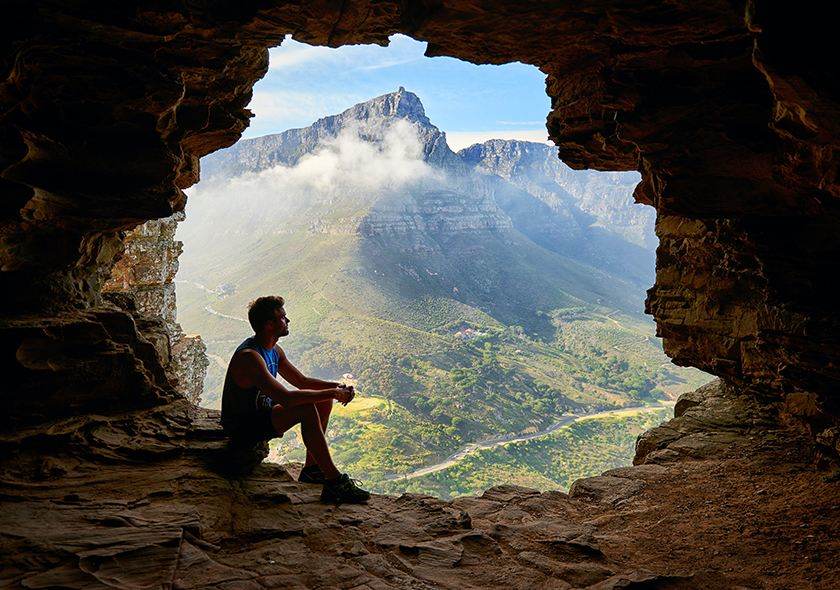

New Card Design

The Mirror Platinum Card is a special, limited-edition Card design available to new and existing Platinum Card Members.

New and Enhanced Benefit Details

£120 Uber One Credit

You can now receive up to £120 in statement credits each calendar year after you purchase an auto-renewing Uber One membership with the Platinum Card®. Terms apply.

My Take: Uber One gives you £0 delivery fee, 6% back on rides, up to 10% off orders and a few more little perks. If you pay for Uber One, this is a straight savings. This will also make it easier to use the monthly Uber credits the card comes with.

Increased Hotel Credit: two £300 credits 2x a year

The hotel credit has now increased from £250 per year to a new potential total of £600 per year. The perk now gives £300 back in statement credits semi-annually for up to a total of £600 in statement credits per calendar year. These credits are given for prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel when you pay with your Platinum Card®. Note that The Hotel Collection requires a minimum two-night stay.

Each of these bookings comes with other complimentary benefits, such as a room upgrade at check-in (when available) and a complimentary credit valued at £100 to use towards eligible charges, such as food and beverage, spa, or other on-property charges, which varies by property. They often include breakfast for two people as well.

Certain room categories are not eligible for upgrade.

My Take: This has theoretically more than doubled in value from the previous credit. I never found this credit easy to use when I had a Platinum card but now some websites like MaxFHR make that easier.

New Hotel Status for Leaders Club

You can now receive complimentary “Leaders Club Sterling Status” from The Leading Hotels of the World®. This gives you some additional benefits at The Leading Hotels of the World which include over 400 independent luxury hotels worldwide. Those benefits include upgrade opportunities subject to availability, daily breakfast for two, and on-property perks. Enrollment required.

My Take: For most people who read this blog, I’m going to assume this isn’t worth much. But if you happen to stay at these hotels, it will be nice!

£400 Resy Credits + Platinum Nights by Resy

With the £400 Resy Credit, you can get up to £100 in statement credits each quarter when you use the Platinum Card to make eligible purchases with Resy, including dining purchases at over 10,000 U.S. Resy restaurants. Enrollment required.

You also get access to Platinum Nights by Resy, which offers sought after reservations at participating top Resy restaurants on select nights. Add your eligible Card to your Resy profile to explore and book Platinum Nights reservations. Restaurants are located in New York, Los Angeles, and Miami.

My Take: The fact that this is a quarterly credit just makes it more of a pain to use. That means you have to be sure to use it four times per year. That immediately lowers the appeal for me. That being said, there are a lot of qualifying restaurants and so I think a lot of people will be able to use this. If you plan to use this, don’t forget to enroll FIRST otherwise you won’t get your credits. You’ll need to enroll via your Amex login, sign up for Resy, and then add your Platinum card to your Resy account. Then you can dine at any of the Resy restaurants and pay directly with your Platinum card to trigger the credit.

Increased Digital Entertainment Credit: Now £300 + More Options

You are eligible to get up to £25 in statement credits each month when you use your Platinum Card to subscribe to your choice of one or more of the following: Disney+, a Disney+ bundle, ESPN+, Hulu, The New York Times, Paramount+, Peacock, The Wall Street Journal, YouTube Premium, and YouTube TV or make eligible purchases with these partners. Enrollment is required to receive this benefit.

Previously, this credit was £240.

My Take: I appreciate the expanded places you can use your credit including YouTube Premium and YouTube TV. This credit is still fairly limited in scope but most households likely use at least a few of these services.

£300 Lululemon Credit

With the £300 Lululemon credit, you can get up to £75 in statement credits each quarter when you use the Platinum Card for eligible purchases at U.S. Lululemon retail stores(excluding outlets) and Lululemon.com. Enrollment required.

My Take: Again, like the new Resy credit — the fact that this is a quarterly credit just makes it more of a pain to use. That means you have to be sure to use it four times per year. That immediately lowers the appeal for me. If you plan to use this, don’t forget to enroll FIRST otherwise you won’t get your credits.

£200 Oura Credit

Receive up to £200 in statement credits when you use the Platinum Card to purchase an Oura Ring at Ouraring.com each calendar year. Enrollment required.

My Take: The cheapest Oura ring is £199 so this covers that but then you still need a subscription to the service. Truly just a coupon here for something you may not even plan to buy.

What’s Staying the Same

Many of the perks and benefits of the Platinum card are staying the same.

Points Earning Structure

No changes here. Card members and authorized users earn points at the same rate as before:

- 5x points on flights booked directly with airlines or with American Express Travel

- 5x points on prepaid hotels booked with AmexTravel.com

- 1x points on everything else

Lounge Access

The Platinum card gives you access to over 1,550 lounges through the Global Lounge Collection. This includes:

- Centurion Lounges (no complimentary guests, unless you spend £75,000 per year)

- Priority Pass Select Membership (enrollment required, 2 guests)

- Escape Lounges (2 guests)

- Delta Sky Club (when flying on Delta but must book above Basic Economy; 10 lounge visits per year)

- Plaza Premium Lounges (2 guests)

- Select Lufthansa Lounges (when flying Lufthansa)

My Take: The lounge and guest access rules are a bit convoluted. For the Centurion lounges, you’d have to dedicate a lot of spending to get lounge access. But Priority Pass still includes 2 guests which after February 2026 is more than Capital One Venture X cardholders can say!

£200 Uber Cash

With the Platinum Card® you can receive £15 in Uber Cash each month plus a bonus £20 in December when you add the Card to your Uber account to use on rides and orders in the U.S when you select an Amex Card for your transaction.

My Take: A little easier to use now that you also get an Uber One membership credited as well. Still a monthly credit takes work to make sure you use it. You can use this for Uber rides or UberEats orders.

£209 CLEAR® Plus Credit

You can cover the cost of a CLEAR® Plus Membership with up to £209 in statement credits per calendar year after you pay for CLEAR® Plus with your Platinum Card®.

My Take: Kids under 18 can go through the CLEAR line with you at the airport for free so this can sometimes help. Occasionally the CLEAR line is shorter than TSA Precheck, but at least at our main airports, it is usually the same.

£200 Airline Fee Credit

Select one qualifying airline and then receive up to £200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card® account.

My Take: This is kind of hard to use. You can see data points here of how to use this.

Credit for Global Entry or TSA Precheck

Receive either a statement credit every 4 years after you apply for Global Entry (£120) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck® (up to £85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Platinum Card®.

My Take: If you’re in this hobby long enough, you probably already have this. If you’re newer, this credit is a good one!

Automatic Hotel Status

Just for holding the Platinum card, you get Hilton Honors™ Gold status and Marriott Bonvoy Gold Elite status.

My Take: Hilton Gold does get you free breakfast outside the U.S. so this is more valuable for international travel.

£155 Walmart+ Credit

Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive one statement credit for up to £12.95 each month. Up to £12.95 plus applicable local sales tax. Plus Ups not eligible.

My Take: Free is free. I wouldn’t probably pay for this but do find it useful when I’m getting it for free. Walmart+ has a unique combo of perks including Burger King coupons and Paramount+.

Credits for Saks and Equinox

Get up to £100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on your Platinum Card®. That’s up to £50 in statement credits from January through June and up to £50 in statement credits from July through December. No minimum purchase required. Enrollment required

Get up to £300 in statement credits each calendar year on a digital subscription or club membership at Equinox. Simply use your Platinum Card® to pay for an Equinox+ digital subscription, or Equinox club membership fees (memberships are subject to auto-renewal).

My Take: Don’t forget to enroll for the Saks benefit before shopping!